Quantifeed’s Advisor-Led solution for Private Banks is a best-in-class digital desktop made to empower Advisors. In our previous article, we discussed the need for Advisors to be equipped with the right tools to reach more customers and increase productivity. Powered by QEngine, our technology platform, the Advisor-Led solution has five key features that will help advisors scale their business and drive the bottom line.

Integrated workflows on a single platform

Quantifeed’s Advisor-Led solution stands out for its capability to simplify proposal generation and perform straight through processing for orders and trades, all within a single platform. This enriches client meetings with relevant and easily accessible information. Dispensing of multiple fragmented systems, our QEngine platform creates connected workflows for viewing investment products, creating advice, and trade processing. This reduces time spent by Advisors in preparing for meetings.

Multiple advice frameworks

The Advisor-Led solution supports multiple advice frameworks that appeal to a broad range of investors. These include recommendation engines for risk-based, goal-based, theme-based, and retirement income solutions. Each of these frameworks enable hyper-personalisation to consider the investment preferences and personal interests of each client. Ongoing monitoring of clients’ positions will aid Advisors in their day-to-day management. Automated alerts can be set to notify Advisors when rebalancing is required to keep their clients’ portfolios aligned with their financial objectives.

Powerful multi-instrument investment analytics

Rich portfolio and scenario analytics power the recommendation engine. The Advisor can access historical and projected performance across a broad range of investment products including stocks, ETFs, mutual funds and structured products, and bonds. Risk and return analytics and stress testing enable Advisors to perform portfolio health checks and guide clients to the next-best-step with ease and confidence.

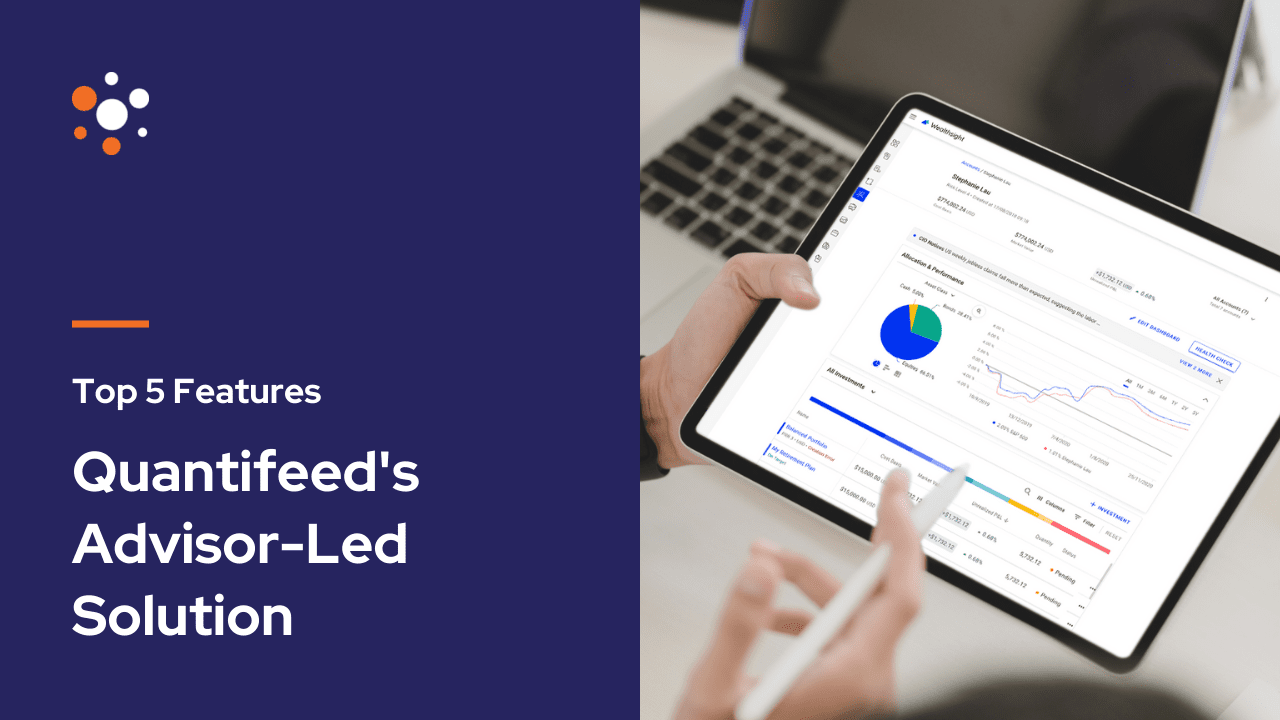

Automated and comprehensive post-sales servicing

The Advisor-Led solution is accessed through a digital dashboard. It provides a summarised view of clients’ investment holdings and performance as well as the functionality to drill deeper into each account. With timely updates on performance and positions, Advisors are called to action when required. These include alerts to update risk profiles or inform clients when stop-loss or profit-taking levels are reached. Advisors can also provide clients with market reports and investment guidance relevant to their investment portfolios.

A digital touchpoint for customers

A client-facing application on a mobile device can be integrated with Quantifeed’s Advisor-Led solution. Clients are empowered to make investment decisions anytime and anywhere on their smart device. They can also access advisor proposals, portfolio information, and reports at their own convenience without needing to schedule an appointment.

Want to learn more about Quantifeed’s Advisor-Led solution? Contact us today to request a demo and find out how our wealth management technology can help strengthen and empower Advisors in Private Banks.