Powerful, modular technology to deliver compelling wealthcare experiences

Grow your customer base and maximise revenues with our modular technology. Our end-to-end architecture facilitates a wide range of wealthcare journeys, enables seamless integration, and incorporates bank-grade security. Access innovative wealth management capabilities on the cloud or on-premise systems.

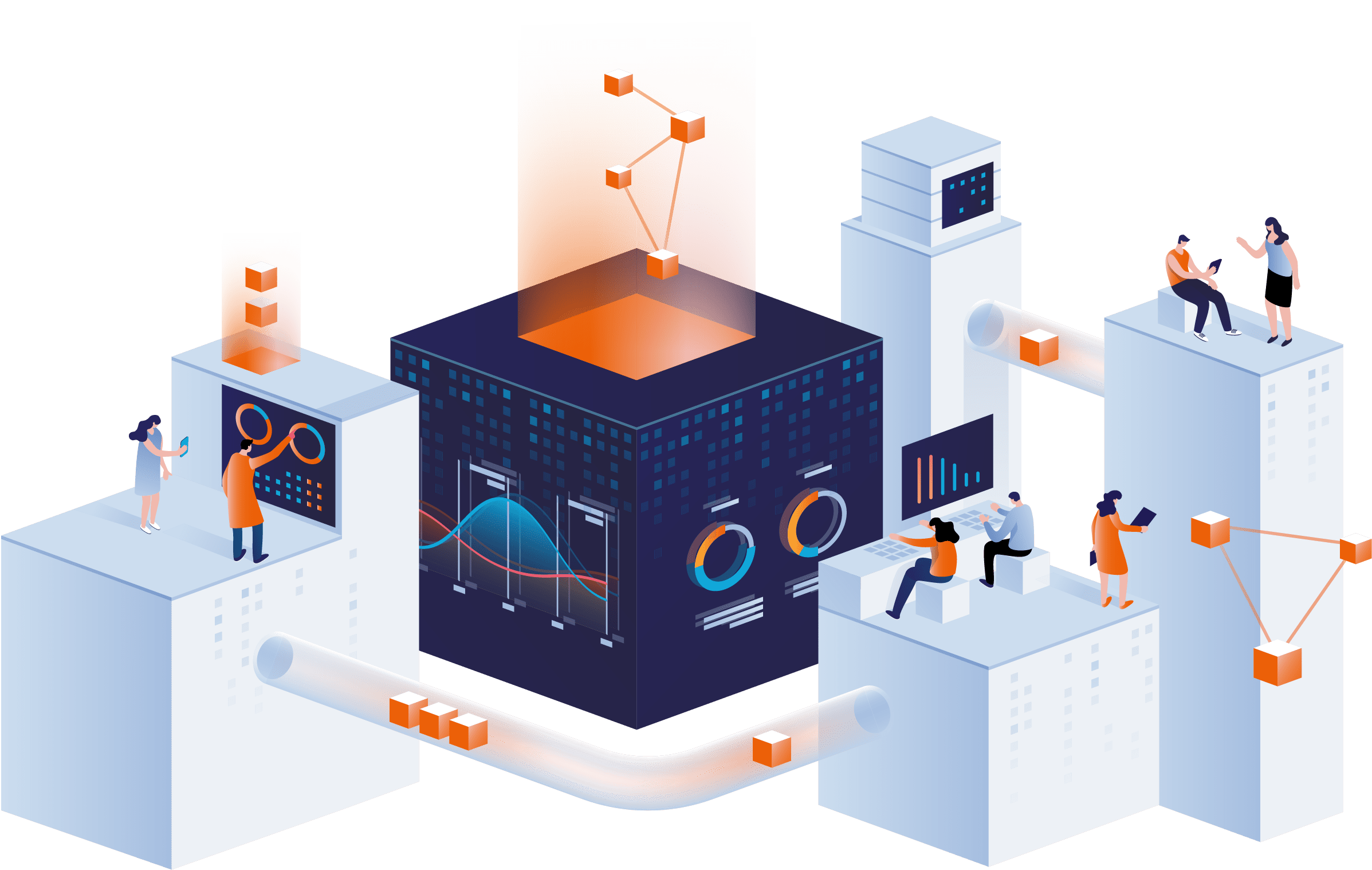

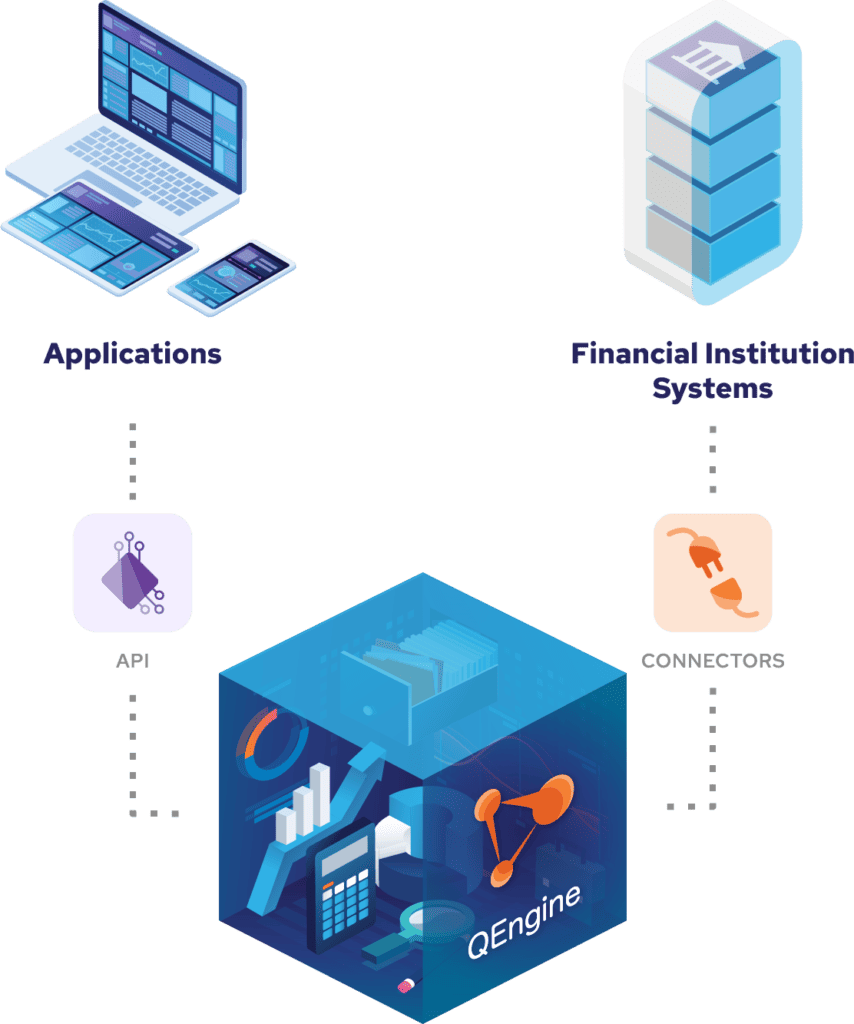

QEngine - Quantifeed's core technology

QEngine powers end-to-end architecture for financial institutions. It connects to existing banking systems, and provides rich capability for straight-through order and trade processing, customer position monitoring, fee management, and reporting.

By integrating with the existing systems, QEngine allows financial institutions, advisors, and portfolio managers to enjoy the benefits of automation and digitalisation, without spending on rebuilding core infrastructures.

Application

API

Manage users, user roles, account structures and investor profiles.

User Management

Account Management

Investor Profiling

Entity Management

Manage the available investment universe from stocks, mutual funds, ETFs to model portfolios.

Instrument Data Management

Portfolio Construction

Portfolio Analytics

Advice Models

Research Content

Monitor and manage investor positions to meet investor goals including portfolio level rebalances, top-ups and withdrawals.

Position Review & Analysis

Position Monitoring

Position Actions

Rebalancing

Generate and execute orders for investment products incorporating instrument restrictions, regulatory checks, routing rules for different exchanges, aggregation, allocation and other order algorithms.

Pre-trade Checks

Order Generation

Order Execution

Order Algorithms

Settlement

Aggregate and manage positions, orders and trades at different levels.

Reconciliations

Corporate Actions

Exception Handling

Transaction Accounting

Support on the operations and management of the proposition

Reporting

Fees Management

Maker Checker

Maintain robust and secure software.

Logging

Authentication

Notifications

System Diagnostics

CONNECTORS

Financial Institution Systems

Manage users, user roles, account structures and investor profiles.

User Management

Account Management

Investor Profiling

Entity Management

Manage the available investment universe from stocks, mutual funds, ETFs to model portfolios.

Instrument Data Management

Portfolio Construction

Portfolio Analytics

Advice Models

Research Content

Monitor and manage investor positions to meet investor goals including portfolio level rebalances, top-ups and withdrawals.

Position Review & Analysis

Position Monitoring

Position Actions

Rebalancing

Generate and execute orders for investment products incorporating instrument restrictions, regulatory checks, routing rules for different exchanges, aggregation, allocation and other order algorithms.

Pre-trade Checks

Order Generation

Order Execution

Order Algorithms

Settlement

Aggregate and manage positions, orders and trades at different levels.

Reconciliations

Corporate Actions

Exception Handling

Transaction Accounting

Support on the operations and management of the proposition

Reporting

Fees Management

Maker Checker

Maintain robust and secure software.

Logging

Authentication

Notifications

System Diagnostics

Manage users, user roles, account structures and investor profiles.

User Management

Account Management

Investor Profiling

Entity Management

Manage the available investment universe from stocks, mutual funds, ETFs to model portfolios.

Instrument Data Management

Portfolio Construction

Portfolio Analytics

Advice Models

Research Content

Monitor and manage investor positions to meet investor goals including portfolio level rebalances, top-ups and withdrawals.

Position Review & Analysis

Position Monitoring

Position Actions

Rebalancing

Generate and execute orders for investment products incorporating instrument restrictions, regulatory checks, routing rules for different exchanges, aggregation, allocation and other order algorithms.

Pre-trade Checks

Order Generation

Order Execution

Order Algorithms

Settlement

Aggregate and manage positions, orders and trades at different levels.

Reconciliations

Corporate Actions

Exception Handling

Transaction Accounting

Support on the operations and management of the proposition

Reporting

Fees Management

Maker Checker

Maintain robust and secure software.

Logging

Authentication

Notifications

System Diagnostics

Increase revenue and reduce cost through digital transformation

Our technology facilitates digital-first, personalised wealth management experiences for users with a variety of goals and expectations.

QEngine seamlessly integrates with existing back-end systems and customer databases of financial institutions, while providing the highest data security.

Our architecture can be deployed on any environment. Reach more customers, enhance your current capabilities, and transform your business quickly.

API-first approach

Using API-first development frameworks with a microservices architecture, we provide full capability and flexibility to create tailored solutions for internal users (advisors, portfolio managers, operations and technical teams) and customers alike.

Seamless integration to accelerate performance

Our powerful, flexible, configurable technology orchestrates and automates information flow across the full range of enterprise systems. Quantifeed Integration Acceleration Technology (IAT) enables connectivity to cloud and on-site systems.

Different

deployment options

QEngine services can be deployed on the cloud, on-premise, or across hybrid infrastructures. Complex data, security and compliance needs are easily catered for, with the flexibility to rapidly adapt to evolving modernisation plans in your organisation.

OUR PARTNERS

Browse our reference documentation including user guides, API references, codes, and articles.