Sustainable investing is no longer just a buzzword. In recent years, investors around the world have placed greater emphasis on a company’s commitment to ESG (Environmental, Social and Governance) criteria. Sustainable investment strategies allow investors to support development goals that meet the needs of the present without compromising the ability of future generations to lead meaningful lives. The rise of ESG investing reflects the value that changing the world for the better is a responsibility as well as an investment opportunity.

Since the UN’s Sustainable Development Goals (SDGs) were set out in September 2015, several climate issues have gained global attention. To name a few, global warming is driven by human-induced emissions of greenhouse gases which lead to large-scale shifts in weather patterns. Water pollution caused by chemicals, rubbish and faecal water damages the environment, negatively impacts health conditions of humans and animals, and disrupts the global economy. A socially responsible investor would choose to focus on industries that are environment-friendly, and invest in companies that contribute to the prevention of water pollution, promotion of energy efficiency and development of clean energy solutions.

Thematic portfolios are a simple solution for tracking these specific industries. Quantifeed Solar-Power-US strategy tracks companies that engage in the solar power business and provide environmentally friendly technology solutions. Quantifeed Water-US allows investors to access companies that provide solutions to secure the supply, preservation, and treatment of water resource. Through Quantifeed Mini-Cleaner-Energy-China-HK, investors can gain exposure to HK-listed clean energy companies that profit from the Chinese government’s initiative to combat air pollution. In term of stock selection, the strategy selects US-listed large cap stocks with strong liquidity and analyst ratings in the solar power or water-related industries. Mini-Cleaner-Energy-China-HK is a mini basket of 5 HK-listed companies whose revenue is mainly from industries related to renewable energy and meet our tradability requirements in terms of board-lot value.

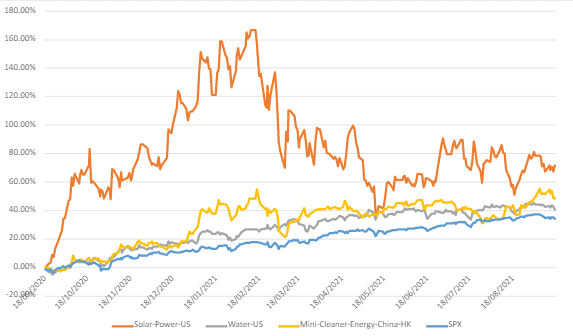

Aligning your investment decisions with sustainable development goals brings you substantial returns and potentially makes the world a better place. As of 17 September 2021, the one-year return of the Solar-Power-US, Water-US and Mini-Cleaner-Energy-China-HK are 71.6%, 40.7% and 48.6%. Meanwhile, their one-year volatilities are at 66.2%, 18.5% and 26.8%. Equally weighted portfolio delivered 53.6% one-year return with 32.7% volatility. With high volatility number of these specific industries, it is more for relatively aggressive investors, or a more creative portfolio construct process can be adapted to mix with other stable strategies.