Discretionary

Broaden your offering and service to a wider audience

Our award-winning technology powers wealth management businesses to deliver scalable and engaging wealth management experiences.

Build compelling wealth management propositions to grow your business more efficiently, and reach underserved customers through a variety of solutions. Read on to see how QEngine powers our products and solutions.

Smart Solutions for Portfolio Managers

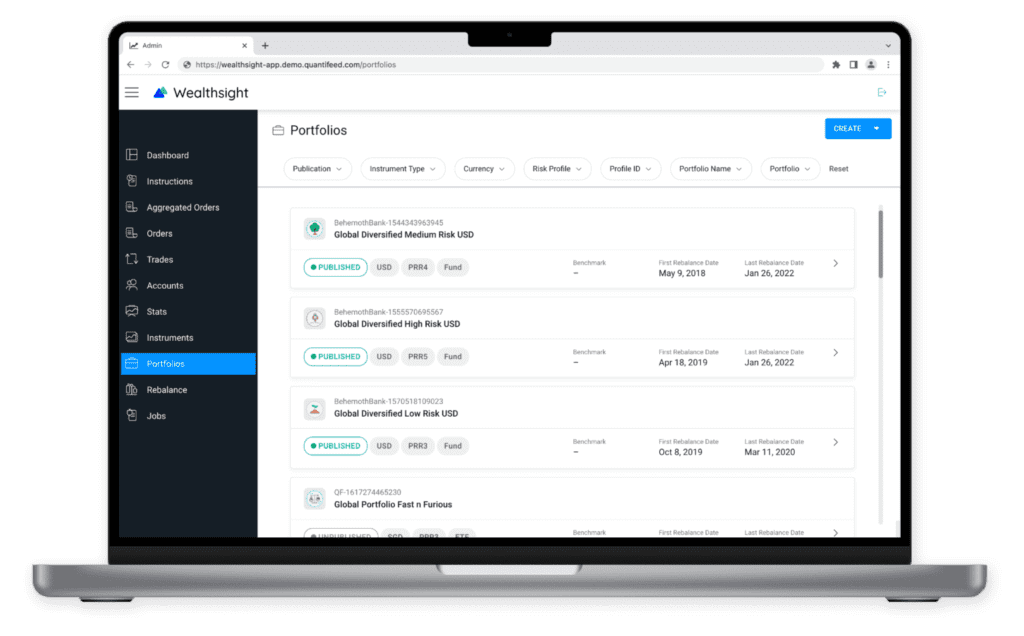

Portfolio Management

Unlock hosting, calculating, and customising model portfolios capabilities that can be done quickly and easily.

Efficient Investing

Access to easy monitoring and reporting functions enables efficient decision making for customer portfolios.

Intelligent Processing

Utilise intelligent automation and bulk processing when trading and rebalancing orders and porfolios.

Mass rebalancing at a touch

Manage your customer portfolios quickly and easily, while adhering to individual jurisdiction and current regulatory compliance. The application enables portfolio managers to carry out discretionary rebalances and other types of actions in bulk or for a single portfolio.

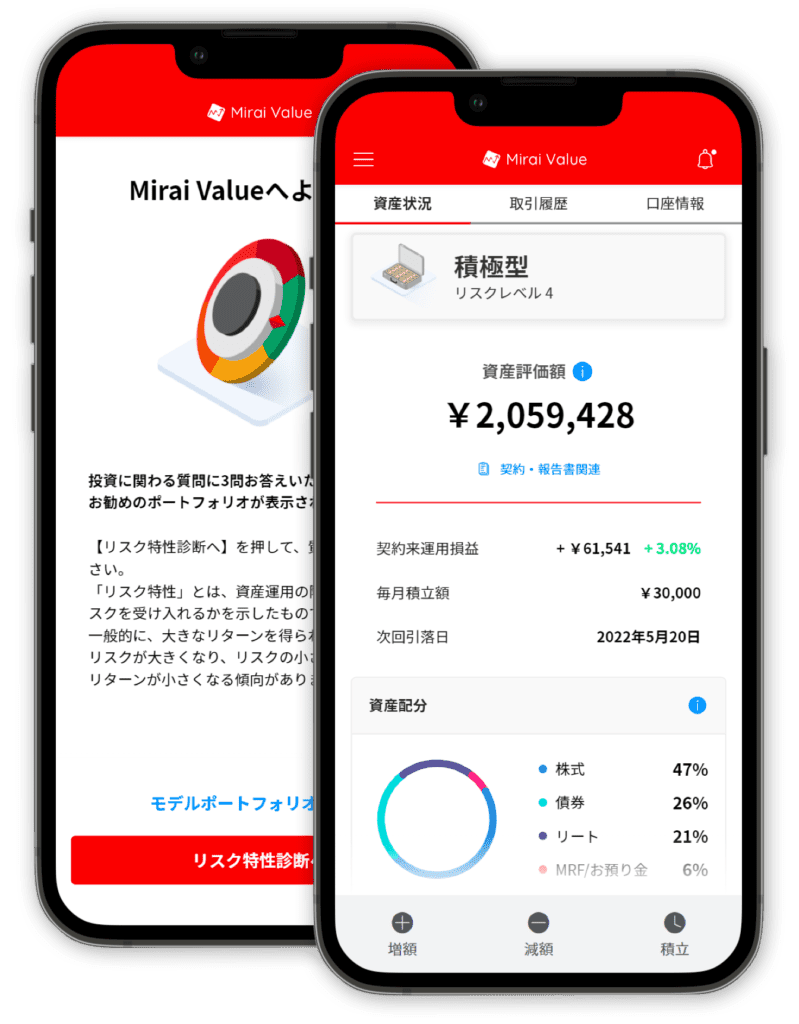

USE CASE

A modern solution to Japan's young and digitally savvy investors

A discretionary portfolio management service made available for first-time investors available on smart devices.

Leveraging Quantifeed’s technology, Mirai Value will empower investors with a professionally managed, well-diversified portfolio, without the need for advanced financial knowledge. We have positioned Mirai Value’s “wealth advice supported by leading technology” as one of our core services, as we would like to support the younger generation’s financial Mirai (future).”

Naoaki Fujitani

Deputy General Manager,

Mitsubishi UFJ Morgan Stanley Securities

FAQ

Discretionary investment management is a form of investment management in which investment decisions are made by a portfolio manager or asset manager for the client’s account. The term “discretionary” refers to the fact that investment decisions are made at the discretion of the portfolio manager (DPM).

Quantifeed’s Discretionary solution is a technology platform and digital tool that enables Discretionary Portfolio Management services to be offered at scale. It facilitates model portfolio creation and simplifies the implementation of strategic and tactical asset allocation shifts when required.

The solution enables discretionary portfolio managers to create model portfolios, monitor and measure customers’ investment portfolios against the recommended model portfolio. It allows mass rebalancing through the aggregation and allocation of orders, strategic and tactical asset allocation shifts, and automatic portfolio rebalancing as markets move. Portfolio managers can carry out discretionary rebalances and other types of actions in bulk or for a single portfolio.

It minimises manual work so portfolio managers can acquire and service a broader range of clients. Easily create, customise, or rebalance model portfolios within compliance constraints with built-in integrity checks. Minimise drift, excessive trading and portfolio locking with automated notifications. Connects seamlessly to back-office systems for portfolio reconciliation and reporting.

Designed for Discretionary Portfolio Managers who have been mandated to manage customer accounts on a discretionary basis, also known as a discretionary management service.

Ready to start?

Speak to us today and find out how Quantifeed can help you deliver engaging wealth management experiences and scale to millions of underserved customers.